What is disability insurance?

Disability insurance helps replace a major portion of your income when you are sick or injured and unable to work. Some people think of it as “paycheck protection.” Others view it as a way to protect their home since a mortgage payment is often a family’s most significant monthly expense.

Having disability insurance can provide a sense of security, knowing that if the unexpected should happen, you’ll still receive a monthly income.

If you think about it, everything you have today - your home, car, groceries, savings - basically your lifestyle, depends on your ability to earn an income. Most people are quick to insure their possessions, such as their home and car. And they generally have life insurance that would provide for their family. But the one thing that makes all this possible is – your income. It’s your most important asset. So, protecting it with disability insurance isn’t just a good decision – it’s essential.

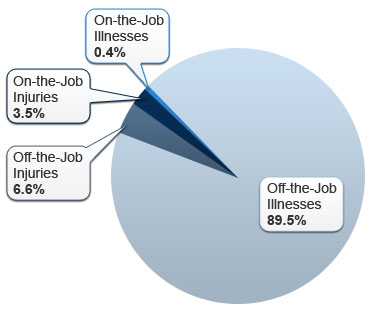

Will I need disability insurance?

No one wants to think about becoming disabled. But the risk is real. What are the odds?

- An illness or accident will keep 1 in 5 workers out of work for at least a year before the age of 651

- Your chance of missing at least 90 days of work due to a disability is just under 1 in 32

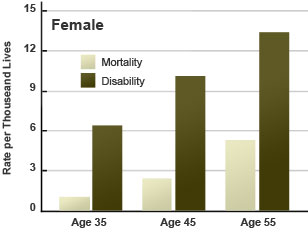

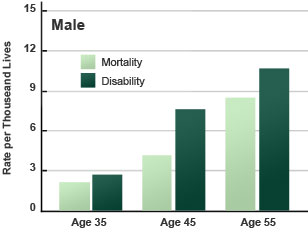

- The risk of disability is greater than the risk of premature death3

What would you do?

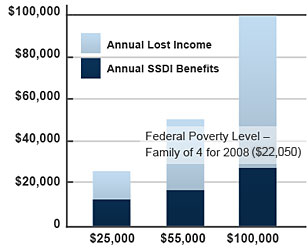

If a disabling sickness or injury happened to you today, how would you pay your bills? Would your savings cover your expenses for 60 to 90 days? That’s assuming the disability is short-term. What if it wasn’t?

Research conducted by the America’s Health Insurance Plan indicates that most Americans cannot afford to miss more than two months of work without having to borrow money. However, it wouldn’t be feasible to get approved for a loan without an income.

Think about how stressful it would be to cope with a disability. Having disability insurance would help relieve the added stress of losing your income.

Risk of Disability Compared to Premature Death

Disability lasting 90 days or longer

Source: National Association of Insurance Commissioners (NAIC), Commissioner’s Individual Disability Table A (1985), Statistical Abstract of the United States, most current available.

Would I have other income sources?

There are three other sources of income that may or may not be available to you depending on your situation.

- Employer-provided Disability Insurance

- Government Disability Insurance

- Workers’ Compensation

However, income from these sources may not be as accessible or sufficient as you may need.

How much does it cost?

A disability insurance policy would be tailored to you, your unique situation and the amount of protection that’s right for you. The monthly premium for a disability insurance policy varies based on several factors:

- Type of policy selected (short-term disability insurance or long-term disability insurance)

- Type of disability covered – accident only or accident and sickness policy

- Optional protection you wish to add

(for example, critical illness benefit, hospital confinement benefit,

future insurability option to name a few.)

- Elimination period* you select

- Benefit period* you select

- Your age at time of purchase

- Your occupation and income

- Medical underwriting

As you can see, every person and situation is unique. That’s why it’s so important to work with a licensed insurance agent who can help you determine the right amount of coverage in a policy that will fit your budget.

* Elimination and/or benefit periods may vary by state.

Get an Online Quote

Short-term Disability Insurance has a lower premium than policies that provide long-term coverage.

Our Online Quote tool can give you a sample monthly premium for a Short-term Disability Insurance policy.

When should I buy?

The best answer is – now. The sooner you consider disability insurance protection, the better. Here’s why:

- Losing your income due to a disabling illness or injury could put the lifestyle you’ve worked hard to build at risk

- A disabling illness or injury can happen at any age. Then it would be too late to purchase this valuable protection

- Premiums are based in part on your age at time of purchase. So, waiting will cost you more

- There’s no obligation to talk to an insurance agent. Our disability insurance experts would be glad to help you review your needs and the options available to fit your budget

Considering all that your income provides, and the financial goals you’ve set, isn’t it important enough to talk to an agent today?